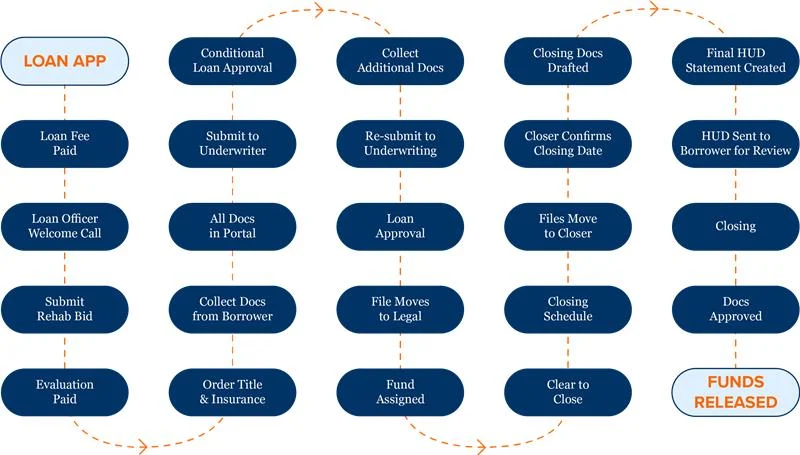

Cogo Capital Loan Process

Cogo Capital’s goal is to close loans as quickly and efficiently as possible. Currently, Cogo Capital’s timeframe to close a loan from start to finish is 21 days. We are working on constantly optimizing this process, but wanted to give you a Logic Based expectation on the current loan flow. Our process is entirely dependent on the cooperation of the Borrower, Title Company-Attorney Office, Evaluation Company, and the Cogo Capital staff. Collectively we are all working together to achieve the end goal – A Closed Loan.

The three areas that people seem to have the most trouble with are:

01

The Bid

02

Request for Inspections/draws

03

The Lien waiver

One of the most important documents to a loan file is the itemized contractor bid.

This document follows the loan from start to finish.

The loan officer uses it to send to the appraiser.

The appraiser uses it for the evaluation of the rehab.

The underwriter uses it for the total cost of the loan.

The draw dept. uses it for the reimbursement of the rehab funds.

It is very important to get the itemized bid as accurate from the start as possible. If you are unsure about the rehab, it is always best to make sure that your contractor has budgeted a contingency for those unexpected items. Who knows what is behind the walls or under the floor?

Bids should be broken down by category to include everything in the house for that category with an explanation of the scope of work.

Example: Paint

Is the paint interior or exterior?

Scope of work for painting interior – what interior items will be painted? Rooms, bathroom, kitchen, living room, cabinets, trim, closets, doors, etc.

Once your loan closes and before your first draw, get in touch with the draw department at draws@cogocapital.com and make sure that the cost breakdown that is in the system is correct before ordering the inspection. This will eliminate a lot of frustration for everyone involved and you will have a better experience with the draw department.

Next is the request for inspections. If you follow the template below your request for an inspection will go smoothly without a hitch. Put the loan number in the subject line.

- Clients last name:

- Rehab address:

- Contact name:

- Contact number:

- General contractor’s email:

- Type out completed items:

Last is the lien waiver. Make sure to fill it out completely. Don’t leave anything blank. If you don’t understand something, ask.

Loan Examples

The following loans are for education purposes only. They do not represent actual loans executed by Dempsey Funding / Dempsey Funding powered by COGO Capital.

Loan Example 1

Dempsey Funding powered by COGO Capital makes a fix and flip loan to Gail for a renovation project in Houston, TX, on a house that costs $300,000. The terms of the loan include a 80% loan to value (LTV), so she must contribute 20% of the price as cash to closing, making the principle note amount $240,000. The terms of the loan dictate a 14% note for 6 months. They also stipulate a 2 point origination fee, that will also need to be paid when the property closes.

On top of the $4,800 origination fee, Gail will also fund $60,000 of the purchase with her own cash, or 20% of the purchase price. The lender will collect $2,800 in monthly interest from the Gail. This is calculated by taking the full note value of $240,000, multiplying that by the 14% interest rate, and then dividing that number by 12. Assuming she sells the remodeled project for $435,000 at the end of the 6 month term, her total profit (not accounting for remodeling costs) would be $113,400. This is calculated by taking the purchase price ($435,000) and subtracting the original principle ($240,000), the origination cost ($4,800), the cash she contributed to closing ($60,000), and the total interest payments ($16,800).Loan costs)

Loan Example 2

Jorge takes a fix and flip loan from Dempsey Funding powered by COGO Capital in order to remodel a house to resell in Houston, TX. The deal has the following terms:

$210,000 purchase price

80% loan to value (LTV)

18 month term

13% interest rate

2% origination fee

Jorge plans to list the house at the end of the term for $304,500. If he achieves this goal, the final numbers will be as follows:

$304,500 sales price

– $168,000 loan principle (80% LTV)

– $42,000 down payment (20% on 80% LTV)

– $3,360 origination fee (2% of the $168,000 principle)

– $32,760 total interest paid (18 months x 13% interest)

———————–

= $58,380 gross profit (does not include taxes or rehab costs)